SOL Price Prediction: Analyzing the Path to $206 and Beyond

#SOL

- SOL shows bullish technical indicators with MACD crossing above signal line

- Institutional buying and network activity signal strong fundamental support

- Long-term price predictions remain highly speculative but optimistic

SOL Price Prediction

SOL Technical Analysis: Bullish Signals Emerge

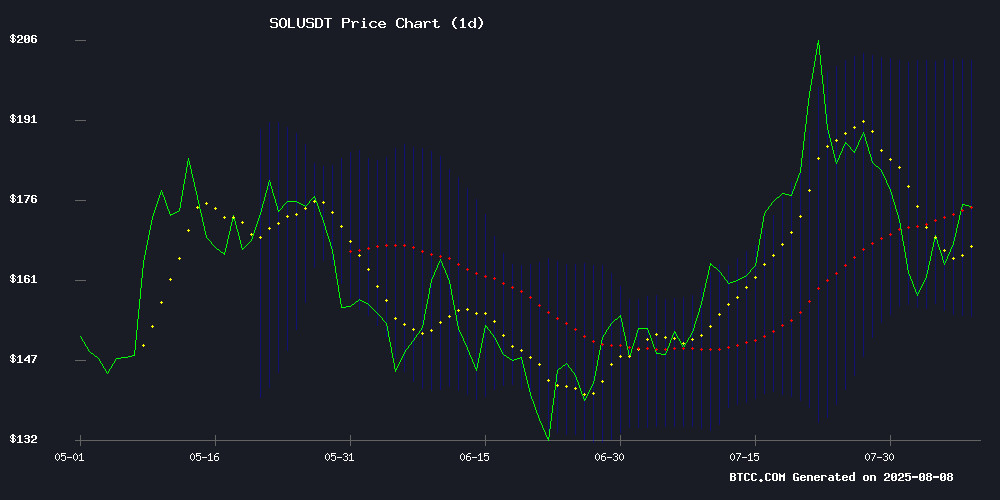

According to BTCC financial analyst William, SOL is currently trading at 174.43 USDT, slightly below its 20-day moving average of 178.2330. The MACD indicator shows bullish momentum with a value of 9.8307 above the signal line at 2.0170. Bollinger Bands suggest potential volatility, with the upper band at 201.9362 and the lower band at 154.5298. William notes that a break above the 20-day MA could signal further upside towards the upper Bollinger Band.

Market Sentiment Turns Bullish for Solana

BTCC financial analyst William highlights growing institutional interest in SOL, with nearly $600 million in recent buying activity. News headlines suggest strong momentum, with price targets ranging from $180 to $206 in the NEAR term. William cautions that while technical indicators are positive, SOL faces competition from new blockchain projects that have raised over $32 million recently.

Factors Influencing SOL's Price

Solana Builds Momentum from Key Support: Is $206 Within Reach?

Solana (SOL) shows signs of a bullish resurgence after rebounding from a critical support zone NEAR $155. The confluence of an ascending trend-line and Fibonacci retracement levels (0.618–0.7) suggests potential for upward momentum. Technical indicators, including the Stochastic RSI in oversold territory, hint at a local bottom formation—a precursor to strong rallies in trending markets.

On-chain data reinforces the optimism. CryptoQuant metrics reveal whale accumulation at current prices, while retail investor activity under $1 million has surged. This dual demand from large and small holders reflects growing confidence in SOL's trajectory. Market structure now mirrors historical setups that preceded significant price advances.

Institutional Solana Buying Ramps Up: The Nearly $600 Million Buy Shaking Up SOL

Solana is experiencing a surge in institutional demand, with publicly traded companies now holding over $591 million worth of SOL. Four firms—Upexi, DeFi Developments Corp, SOL Strategies, and Torrent Capital—have collectively acquired more than 3.5 million SOL, marking one of the strongest waves of corporate accumulation in the asset’s history.

Leading the pack is Upexi, a solana treasury company, which has acquired 1.9 million SOL at an average cost of $168.63 per token, investing approximately $320.4 million. Despite a slight dip in current valuation, the entire amount is staked, earning an 8% annual yield as of June 30.

DeFi Developments Corp follows closely, with approximately 1,182,685 SOL in its treasury. The company recently added 181,303 SOL on July 29 at an average price of $155.33 per token, maintaining an aggressive accumulation pace.

Technical Indicators Signal Bullish Momentum for Solana as Price Eyes $180

Solana's market structure shows strengthening bullish signals as technical indicators align for a potential breakout. The SOL/USD pair's Balance of Power (BoP) reading of 0.76 confirms buyer dominance, with prices consistently closing near session highs.

Momentum continues building as the Relative Strength Index (51.65 and rising) reflects accelerating buying pressure. This technical confluence comes as SOL tests key resistance levels, with traders now targeting the $180 psychological barrier.

The cryptocurrency's recovery appears increasingly sustainable as on-chain metrics and trading patterns demonstrate conviction among market participants. Market technicians note the absence of distribution patterns typically seen during bearish reversals.

$GOHOME Joins TrustyFi to Boost Transparency in Solana Memecoins

TrustyFi has integrated the Solana-based memecoin project $GOHOME into its Verified Projects Hub, marking a step toward greater transparency and community engagement in the Solana ecosystem. The platform will host user-generated reviews of $GOHOME, monitored to ensure authenticity and curb misinformation.

As part of the collaboration, $GOHOME community members can participate in incentivized review campaigns on TrustyFi, earning USDT rewards for genuine feedback. The initiative aims to foster trust and active participation within the memecoin space.

Solana's Rally Sparks Speculation of $200 Target Before 2026

Solana (SOL) has reignited bullish momentum, rebounding from $157 support to trade near $173—a 5% surge in 24 hours. While weekly performance remains slightly negative, the shift in sentiment is unmistakable. The cryptocurrency now faces a critical test: reclaiming its recent $200 peak, which would require just a 16% climb from current levels.

Market structure appears favorable, with SOL establishing higher highs and lows on intraday charts. Trading volumes tell the same story—$4.4 billion in spot transactions and $4.6 billion in open interest confirm renewed participation. This resurgence coincides with growing institutional interest, including spot ETF filings and network upgrades that position SOL as a leading altcoin narrative entering 2025's final quarter.

The ecosystem effect is already visible. Projects like Snorter, a Solana-native trading bot specializing in meme coins and DEX trades, are gaining traction alongside the network's recovery. Such developments suggest SOL's rally could have staying power beyond short-term technical moves.

Analysts Bullish on SOL as Technical Indicators Point to Potential 50% Surge

Solana's native token SOL could be poised for a significant breakout, with technical analysts predicting a potential rise to $255 if key support levels hold. The cryptocurrency currently trades at $171, having gained 12% over the past month.

Market observer Mary Emerald highlights a bullish Golden Cross formation, noting that maintaining prices above $161 could trigger the upward move. The prediction gains credence from recent on-chain activity showing $243 million flowed into Solana's ecosystem this week, predominantly from Ethereum-based assets.

The anticipated rally WOULD likely boost activity across Solana's DeFi landscape. Emerging projects like Snorter Token (SNORT) stand to benefit particularly, with its Telegram trading bot scheduled for launch this quarter.

Solana Price Prediction: All-Time High Network Activity Signals $1,000 SOL Incoming

Momentum is building on the Solana network as fresh on-chain records signal renewed strength beneath the surface. With altcoin season sentiment gaining traction, Solana has logged its highest-ever non-voted transactions and true TPS, averaging 1,318 in July—a sharp rise in real network usage.

Despite trading 75% below its all-time high, these metrics are fueling bullish price predictions. DefiLlama reports Solana's native token TVL has surged to a three-year peak, nearing 60 million tokens, indicating growing stickiness among users and DeFi protocols.

The macro backdrop is shifting in favor of risk assets, with speculators anticipating up to three Fed rate cuts by year-end. This liquidity influx could catalyze an altseason, with Solana poised to capitalize. The question now: Can SOL reach $1,000?

Solana Faces New Competitor With Over $32 Million Raised in 60 Days

Solana's price struggles contrast sharply with its robust on-chain metrics. While SOL dipped nearly 10% last week, its ecosystem shows remarkable growth—stablecoin volume surged 500% month-over-month, and Total Value Locked (TVL) climbed 2.67% in 24 hours. Institutional interest remains strong, with DeFi Dev Corp. increasing its SOL holdings by 91% to 1.18 million tokens worth $204 million.

Meanwhile, Unilabs Finance emerges as a formidable challenger, raising $32 million in two months. The AI-powered platform is attracting capital from SOL investors seeking next-generation asset management solutions. This shift highlights the competitive pressures facing established layer-1 blockchains as innovative alternatives gain traction.

SOL Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market sentiment, BTCC financial analyst William provides these long-term projections for SOL:

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | 180-220 | Institutional adoption, ecosystem growth |

| 2030 | 500-800 | Mainstream DeFi adoption, scalability solutions |

| 2035 | 1,000-2,500 | Potential Web3 dominance, enterprise use cases |

| 2040 | 3,000-5,000 | Network effects, possible store-of-value status |

William emphasizes these are speculative estimates and actual performance depends on technology developments, regulation, and broader crypto market conditions.